Our operations

B2B

Providing technology to gambling operators globally through a revenue share model and, in certain agreements, taking a higher share in exchange for additional services.

Revenue

€684m

Adjusted EBITDA

€182m

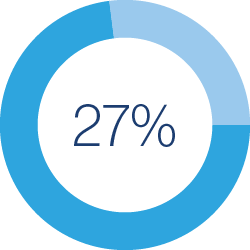

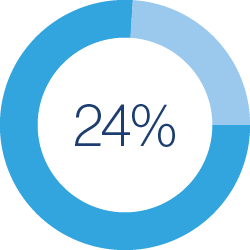

Adjusted EBITDA margin

B2C

Acting directly as an operator in select markets and generating revenues from online gambling, gaming machines and retail betting.

Revenue

€1,037m

Adjusted EBITDA

€250m

Adjusted EBITDA margin

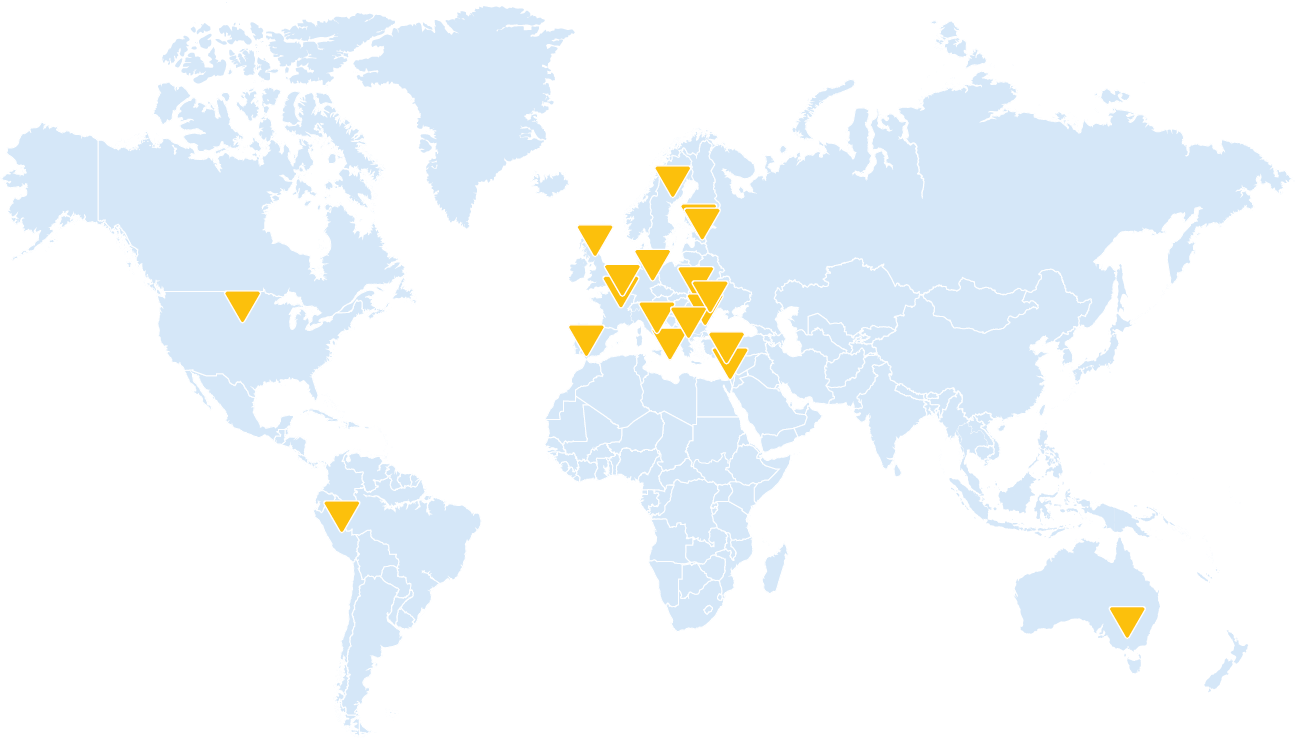

A global company

Playtech was established at the inception of the online gambling industry and possesses unparalleled knowledge and expertise in the sector, with over 20 years of experience and investment in technology. Playtech’s global scale and distribution capabilities, with over 180 licensees operating in over 40 regulated markets and with offices in 19 countries, mean we are ideally positioned to capture opportunities in newly regulating markets and high-growth markets with low online penetration.

19

Countries with offices

>7,700

Colleagues

>180

Licensees

>40

Regulated jurisdictions

Product and Innovation

Providing market-leading solutions through Playtech’s bespoke technology

Through our proprietary technology solution, Playtech has pioneered omni-channel gambling technology which provides an integrated and open platform across retail and online for all key verticals, delivering a safe and seamless customer experience.

Highlights of the year

|

|

||||

|

|

- From continuing operations.

B2B – strengthening across key markets |

||||||||

|

|

|

||||||

B2C – delivering across both retail and online |

||||||||

|

|

|

||||||

Championing sustainability across the Company |

||||||||

|

|

|

||||||

|

|

||||

|

|

- From continuing operations.

B2B – strengthening across key markets |

||||||||

|

|

|

||||||

B2C – delivering across both retail and online |

||||||||

|

|

|

||||||

Championing sustainability across the Company |

||||||||

|

|

|

||||||

Americas: the land of opportunity

With a well-established presence in the US including three Live studios operational and multiple brands including Hard Rock Digital, Playtech is well placed to take advantage of the huge opportunity in the US market.

|

|

$41bn

Size of the US market over the long term based on GGR

3

Live studios operational in the US

Playtech is well placed to benefit from the on-going expansion of Canadian market via a comprehensive structured agreement with a prominent local operator NorthStar as well as more than 10 other operators and launched with FanDuel for Live in Ontario.

|

|

$6bn

Size of the Canadian market over the long term based on GGR

Brazil is a global economic powerhouse, is deeply passionate about sports and now home to one of the most exciting markets in gambling. Brazil’s large population of 215 million and promising regulatory environment make it an exceptionally attractive market opportunity, with online sports betting and casino expected to reach $5 billion GGR in the next five years.

|

|

$5bn

Size of the Brazilian market over the long term based on GGR

With a well-established presence in the US including three Live studios operational and multiple brands including Hard Rock Digital, Playtech is well placed to take advantage of the huge opportunity in the US market.

|

|

$41bn

Size of the US market over the long term based on GGR

3

Live studios operational in the US

Playtech is well placed to benefit from the on-going expansion of Canadian market via a comprehensive structured agreement with a prominent local operator NorthStar as well as more than 10 other operators and launched with FanDuel for Live in Ontario.

|

|

$6bn

Size of the Canadian market over the long term based on GGR

Brazil is a global economic powerhouse, is deeply passionate about sports and now home to one of the most exciting markets in gambling. Brazil’s large population of 215 million and promising regulatory environment make it an exceptionally attractive market opportunity, with online sports betting and casino expected to reach $5 billion GGR in the next five years.

|

|

$5bn

Size of the Brazilian market over the long term based on GGR

Review of the year

Chairman’s statement

“We have a clear and proven strategy across both B2B and B2C, underpinned by outstanding products and extremely talented colleagues in some of the most exciting and fastest growing markets worldwide.”

Chief Executive Officer’s statement

"The Group made important financial, strategic and operational progress in 2023. Looking ahead, we remain very confident in our ability to execute our strategy and to deliver value for our shareholders."

Chief Financial Officer's statement

"2023 saw a strong financial performance across both B2B and B2C, with Adjusted EBITDA ahead of previously raised expectations."